Can I Afford a Senior Living Community?

Comparing the value of a retirement community to living at home

Many people assume that aging in place at home will be the most cost-effective option for their retirement years. However, when they begin to look at the details and compare the value of living in a retirement community to the costs associated with remaining in their home, they often are surprised to learn that many retirement communities are more affordable than they originally thought. You may wonder how this is possible. Let’s take a look.

Mortgage-free doesn’t mean free.

As all homeowners know, the cost of owning a home isn’t limited to making a mortgage payment. Even if your house is paid off, there are substantial ongoing costs that remain as long as you own it, including taxes and insurance, maintenance and upkeep, homeowners association dues, and more. In addition, appliances and systems like plumbing and HVAC have a way of breaking down at the most inopportune times, often leaving homeowners with hefty bills for repairs or replacement. Add in things like replacing the roof, the water heater or flooring, and the costs can really add up.

Aging in place will also mean new expenses.

While you may be able to take care of things like housekeeping, window washing, lawn care and landscaping on your own now, most people end up needing to hire outside help as they get older. You also may need to make modifications to your home so you’ll be able to live there safely. Adding things like grab bars or installing a lift or ramp are common, as are widening doorways to accommodate a wheelchair, changing out doorknobs for handles, or even remodeling a bathroom. Also consider any smart-home or health alert technologies you may want to use. In addition to installation, you‘ll likely pay monthly fees for monitoring of these systems.

Consider the cost of future health care needs.

If you plan to contract for in-home care, research local service providers and find out about typical charges for in-home care. Genworth’s current Cost of Care Survey can provide useful information and projections for the future cost of care in many areas of the country.

In short, it’s a good idea to add up all the costs associated with owning and continuing to live in your home, so you can understand and accurately compare it to the cost of living in a retirement community.

Calculating the cost of a senior living community.

Senior living communities generally charge a monthly fee that includes your residence and an array of services and amenities. Life Plan Communities — also known as Continuing Care Retirement Communities (CCRCs) — typically have an entrance fee and monthly fees that are based on the type of residence and type of contract you choose.

Many Life Plan Communities and CCRCs offer Life Care contracts that cover all or most of your health care costs at the community, regardless of the level of care you require. They provide security and peace of mind that you won’t be surprised by exorbitant fees if you ever need residential care, memory care, short-term rehabilitation or nursing care. What’s more, there may be tax advantages associated with moving into a senior living community, as the IRS has, in the past, allowed a portion of community entrance fees and monthly fees to be deducted as prepaid medical expenses.*

*Consult your tax advisor for details about how this may apply to your personal situation.

One monthly fee replaces many individual bills — and all the hassles.

When you live at a senior living community, your monthly fee covers a wide variety of things. First, it covers your residence and all maintenance. You won’t have to pay real estate taxes or carry homeowners insurance, and you’ll never be stuck with expensive bills to repair or replace any appliance or system. You won’t even have to change a lightbulb. Your monthly fee will also cover lawn care, landscaping and maintenance, and typically covers all utilities and many additional services like housekeeping and 24/7 security.

Never cook again — unless you want to.

When you move to a senior living community, your independent living residence will include a full kitchen, so you’re always free to cook for yourself when you want to. However, many people enjoy having someone else take care of the shopping, food preparation and cleanup. Most senior living communities offer a dining plan that can cover every meal or, if you prefer, one or two meals per day. You’ll usually find chef-prepared culinary options that range from grab-and-go cafes and casual dining with table service to fine dining restaurants. Changing menus that incorporate the freshest locally sourced ingredients are popular, as are pubs. Many communities also have periodic themed meals and special events, wine-pairing events, cookouts, and more.

Compare for yourself.

There are many factors that go into choosing where you’ll live and, for many people, cost is a significant consideration. We’ve created a free, downloadable worksheet to help you calculate the costs of aging in place at home and compare that to the costs and value of a senior living community. Contact us to be directed to the Cost Comparison Calculator or find it on the Capital Manor website.

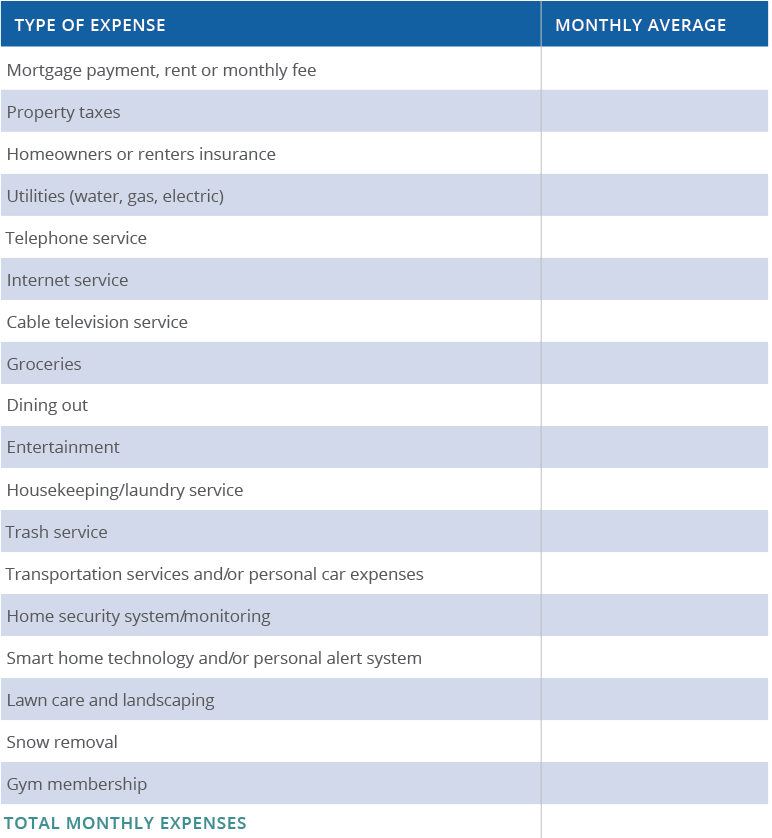

COST COMPARISON WORKSHEET

Print and complete this worksheet to get a clear understanding of the cost of aging in place at home versus residing in a senior living community.

In addition to completing this worksheet, consider and estimate the cost of future care you may potentially need. This could include in-home assistance and nursing care, as well as modifications that may be necessary to make your home safer and easier to navigate.

Capital Manor offers an exceptional value in senior living. As you consider your options, feel free to call our sales and marketing team at 503-967-3086 to ask questions or request additional information. We know it’s an important decision, and we want to help you make the choice that’s right for you.